5G cellular technology has tremendous promise, with the potential to transform a wide range of industries and to contribute to economic growth and job creation. In the year 2020, more of us rely on fast, reliable, low-latency communications than ever before, and 5G technology will permit this to continue. As such, there has been a great deal of interest in which companies own the patents for the technology, and various 5G patent landscaping reports have been published by various consultancy and analyst firms. Typically, these reports rank the major players, charting the proportion of 5G patent families owned by each company. However, there is significant disagreement between reports as to which companies and which countries are leading.

As 5G is a standardised cellular technology, patent holders disclose their potentially essential 5G patents to the European Telecommunications Standards Institute (ETSI). The declaration database managed by ETSI represents an important input for 5G patent landscaping reports. However, since not all patents disclosed as potentially essential to the 5G standard are truly essential (a concept known as over-declaration), it is necessary to filter out non-essential patents using studies called essentiality audits, which assess the proportion of declared patents which are actually essential. However, many of the landscaping reports do not incorporate the findings of an essentiality audit, and many do not adjust for over-declaration in any way. Therefore, many of these 5G patent landscapes are likely to misrepresent each company’s share of 5G patents, especially as essentiality audits have shown that the rate of over-declaration can vary significantly by company.

twoBirds Pattern 5G landscape by country/region

twoBirds Pattern of Bird & Bird LLP have published several 5G studies which incorporate robust essentiality audit data, including a May 2019 article in IAM. Their most recent publication analysed 5G patent ownership by country of origin and found, contrary to some mainstream media reports, that it is Europe, rather than China, that is leading the 5G patent race. Their analysis applied essentiality audit data used by the judge in Unwired Planet v Huawei and a more extensive audit performed by the same expert, Dr David Cooper, published in Les Nouvelles. Both audits involved essentiality reviews of at least five hours per patent family, which is important, as assessing essentiality accurately is not straightforward and studies which have spent less time per patent family have had to incorporate a presumption of essentiality as a result. The audits relied on in the Pattern study were based on 4G patent reviews, as 5G essentiality audits of equivalent thoroughness are not yet available. This is reasonable, as there is no reason to believe that the relevant companies’ essentiality rates differ significantly between 4G and 5G, and using 4G audit data is likely to provide a much more accurate result than ignoring over-declaration.

The Pattern study also applied a quality filter based on the jurisdictions in which each patent family was filed, which was confirmed in Unwired Planet v Huawei to be a sensible measure to restrict the analysis to the most valuable patents.

Assessing 5G SEP leadership at a company level

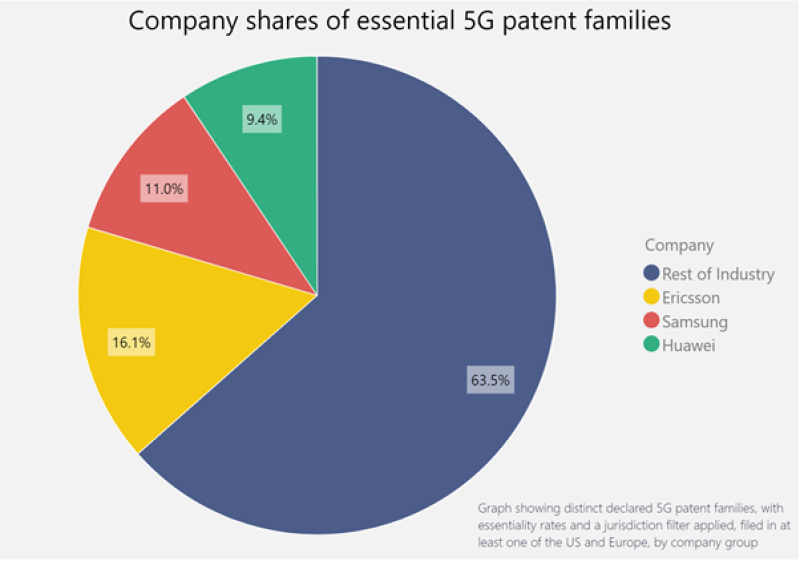

To assess 5G patent leadership at a company level, rather than just a country level, I acquired some of the data underlying the twoBirds Pattern study and performed my own analysis. I identified 5G patent holdings at a company level for three companies of interest: Ericsson, Huawei and Samsung. These companies were chosen because company-specific essentiality rates only exist for these companies in the essentiality audits relied on by Pattern.

I charted 5G leadership for the three companies of interest using a patent family metric, applying essentiality audits and a jurisdictional quality filter. I found that Ericsson is in the lead, with 16.1% of 5G patent families, followed by Samsung with 11.0%, and then Huawei with 9.4%.

Although the jurisdiction filter is a sensible measure to restrict the analysis to the most valuable patents, I confirmed that removing the filter did not have a material effect on the relative scores of the three companies and did not affect their relative ranks.

Other 5G landscaping reports

The essentiality audit data that was used to generate the figure above derives from a court-approved methodology and represents the best data that is presently available for such an analysis. There are other landscaping reports available, such as the preliminary report co-authored by Amplified and GreyB and various reports published by IPlytics, but, on closer inspection, I determined that these reports appear to suffer from serious credibility, transparency, and quality issues, or do not account for over-declaration at all, which make them too unreliable to use in a 5G landscaping exercise.

Amplified provide no information on their landscaping methodology and it is not clear if they have any experience working with declaration databases. GreyB claims to have evaluated 6,402 patent families for essentiality but they do not make clear exactly how much time was spent reviewing each patent family or who carried out the evaluations. If they followed a thorough methodology, then the process would have been very expensive. However, the report was made available free of charge and it is not clear if they had access to external funding.

It is more troubling that the results of the Amplified/GreyB study diverge drastically from the findings of more thorough audits that have used court-approved methodologies:

· Amplified/GreyB found 26% of the reviewed patent families to be 5G-essential, compared to 15.9% for 4G in Unwired Planet v Huawei, and 13% for 4G in the Les Nouvelles study.

· Amplified/GreyB found a 5G essentiality rate for Huawei of 34%, compared to 9.4% for 4G in Unwired Planet v Huawei.

It is highly unlikely that the industry as a whole, and Huawei in particular, has become more stringent in their declaration practices in the 5G era, when declaration counts have grown rapidly and incentives to over-declare have increased.

In conclusion, until more rigorous essentiality audits on 5G patents are published, applying the results of 4G essentiality audits using court-approved methodologies is the best approach. The 5G essentiality audits published to date have serious quality issues and have the potential to confuse the picture in this important, yet complicated, area.

For a longer version of this article, please click here: https://papers.ssrn.com/sol3/papers.cfm?abstract_id=3710223