Three reports came out recently yielding interesting statistics on India’s intellectual property (IP) ecosystem. The 17th edition of the Global Innovation Index (GII) was released in September 2024, followed by WIPO’s World Intellectual Property Indicators 2024 a month later. The Delhi High Court Intellectual Property Division Second Annual Report 2023–24 was also released around that time. A robust image emerges upon putting together information contained in all three, which this article attempts to showcase.

GII 2024

The GII ranks 133 economies on their innovation ecosystems, using a set of 78 indicators. Over the years, India has been consistently enhancing its innovation performance. From being placed 81st in 2015, it ranks 39th in 2024. Furthermore, India continues to be a record holder by being an innovation overperformer (the economy performing above expectation relative to its level of development) for a 14th consecutive year.

The following are notable statistics from the 2024 GII:

India is the most innovative economy in the central and southern Asia region, and among the “lower middle-income” group of countries.

India holds world leadership in information and communications technology (ICT) services exports – it ranks first globally on this indicator.

India secures the top spot globally in “domestic market scale, bn PPP$”, which refers to the size and potential of a country’s market for goods and services, factoring in consumer demand, purchasing power (with “PPP” representing purchasing power parity), economic conditions, etc.

India has the third-largest unicorn ecosystem in the world, behind the US and China.

In a marked improvement, in 2024, India ranks 22nd globally in terms of “knowledge and technology outputs”, which includes patent filings, labour productivity, unicorn valuation, high-tech manufacturing and exports, ICT services exports, etc. In 2022, India ranked 34th on this metric.

India ranks among the top 10 countries in the world with regard to the following indicators: “venture capital received, value % GDP”, “finance for startups and scaleups”, “domestic industry diversification”, “unicorn valuation, % GDP” (the combined value of a country’s unicorns, as a percentage of GDP), and “intangible asset intensity, top 15, %”. According to the GII, the data for the final indicator covers “a global list of firms for which intangible asset value and total firm value are observed. Only the top 15 firms of each economy are considered, ranked by intangible assets in absolute terms (in USD).” Intangible asset intensity is defined as the median-sector level of the ratio between intangible assets and total assets.

India's cultural and creative services exports rose substantially from the previous year – it is placed 13th in the world (up from 18th in 2023).

R&D

The most recently available data shows that global R&D investment growth in 2022 slowed to 5% (down from 6.6% in 2021). Top corporate R&D spenders – the most significant component of total global R&D – increased expenditure by a nominal 7.4% in 2022 (down from 15% growth in 2021). However, software and ICT services recorded exceptionally strong R&D spending growth of roughly 19%. India’s global rank in terms of R&D is 34 and it ranks 18th in the world on the “global corporate R&D investors, top 3, mn USD$” indicator, which takes into account the average expenditure of India’s top three global companies on R&D in 2023.

Top global corporate R&D investors from India in 2023

Rank | Firm | Industry | R&D (mn €) | R&D growth (%) |

107 | Tata Motors | Automobiles and parts | 2,087 | 26 |

707 | Sun Pharmaceutical Industries | Pharmaceuticals and biotechnology | 261 | 8 |

849 | Dr Reddy’s Laboratories | Pharmaceuticals and biotechnology | 208 | 12 |

892 | Reliance Industries | Chemicals | 196 | 54 |

937 | HCL Technologies | Software and computer services | 185 | 7 |

1026 | Aurobindo Pharma | Pharmaceuticals and biotechnology | 167 | -11 |

1144 | CIPLA | Pharmaceuticals and biotechnology | 146 | 20 |

1155 | Lupin | Pharmaceuticals and biotechnology | 145 | -9 |

1171 | Biocon | Pharmaceuticals and biotechnology | 143 | 71 |

1179 | Glenmark Pharmaceuticals | Pharmaceuticals and biotechnology | 142 | -2 |

Source: Global Innovation Index 2024

Science and technology clusters

A common thread among top-performing nations is the presence of thriving science and technology (S&T) clusters – geographical areas around the world with the highest density of inventors and scientific authors. The GII lists the world’s top 100 S&T clusters. In 2024, China, for the second consecutive year, leads with the most top clusters (26) in the world. Four of India’s S&T clusters also feature in the top 100 clusters, as in the previous year – Bengaluru ranks 56th; Delhi climbs one place to 63rd; so does Chennai, which is now at 82; while Mumbai, as last year, ranks 84th.

WIPO World Intellectual Property Indicators 2024: a maturing IP ecosystem

Patent filings

According to WIPO’s World Intellectual Property Indicators 2024, India was one of the main drivers of growth with regard to the rise of global patent filings in 2023. Global patent filings increased 2.7%; however, India posted a rise of 17.2% (driven by a substantial increase in resident filings).

India continues to rank sixth in the world in terms of the number of patent applications filed at the Indian IP office (IPO) in 2023, with 90,298 applications.

Notably, over the past 10 years, the share of resident filings has been increasing and in 2023, for the first time, applicants residing in India accounted for more than half of the patent applications received by the IPO.

India also granted 149.4% more patents in 2023 (76,053 grants) than in 2022.

Another recent statistic that is very interesting features in WIPO’s report titled Patent Landscape Report: Generative Artificial Intelligence. The report states that India ranks fifth globally (behind China, the US, South Korea, and Japan) in terms of the number of generative AI patents published between 2014 and 2023.

Trademark filings

Trademark filings are a good metric for the introduction of new goods and services in an economy. In terms of trademark filings, the IPO ranks fourth in the world according to WIPO’s World Intellectual Property Indicators 2024.

Global trademark filings declined 1.3% in 2023 (from 2022) – in the same period, Indian trademark filings, in contrast, posted a rise of 4.1% (governed by an increase in resident filings) – with 520,862 total applications (class count) filed in 2023.

Design filings

The uptrend in design filings at the IPO has been over 165% in the past decade, from 8,533 filings in 2013–14 to 22,698 filings in 2022–23 (the IPO’s annual report statistics correspond to the financial year that began on April 1 2022 and ended on March 31 2023). From a global perspective, applications only increased 19.8% between 2013 and 2022.

Design applications filed in India rose by 25% in 2023, with 28,168 applications filed that year (WIPO World Intellectual Property Indicators 2024).

Recent government data reveals that 27,819 designs were registered in India in 2023–24, the highest figure ever.

Transformative trends in IP enforcement

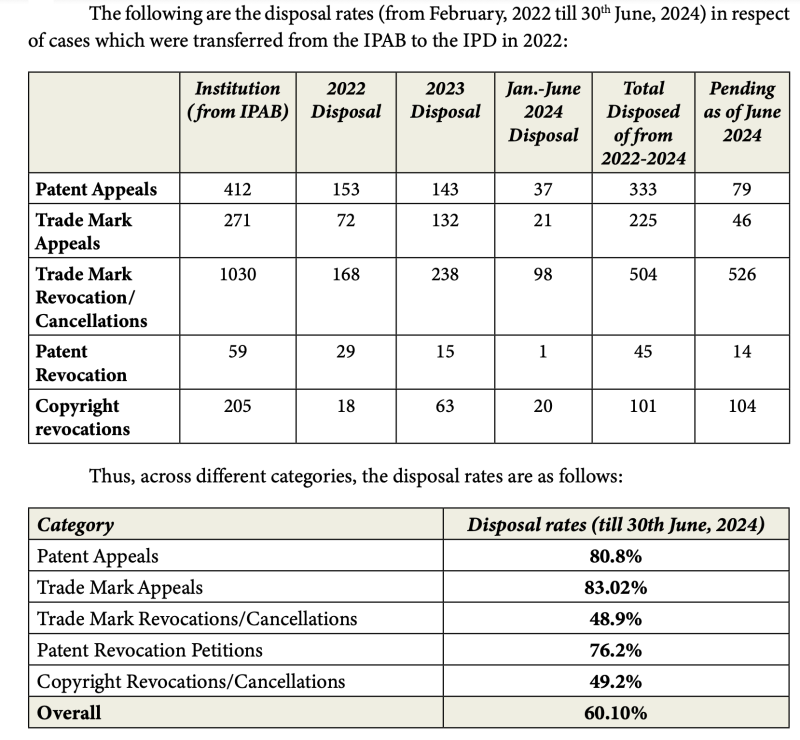

The recently released Delhi High Court Intellectual Property Division Second Annual Report 2023–24 reveals how effective the Intellectual Property Division of the High Court of Delhi is in terms of its mandate to tackle backlogs and make IP litigation in the country more efficient. In its second year, the IP division disposed of 1,217 cases transferred from the Intellectual Property Appellate Board (IPAB). Thus, as of June 2024, more than 60% of the cases received from the IPAB (1,977 cases) had been disposed of.

In addition, from January 2023 to June 2024, the Intellectual Property Division of the High Court of Delhi disposed of 2,026 fresh cases, surpassing the 1,917 new cases instituted during the same period, reducing the overall pendency of IP cases from 3,799 cases in 2023 to 3,742 cases by the end of June 2024.

The tables below (extracted from the Delhi High Court Intellectual Property Division Second Annual Report 2023–24) indicate a growing trend at the IP division in successfully overcoming backlogs. Detailed statistics are furnished in terms of IP commercial suits, patent appeals, trademark appeals, and trademark rectification petitions.

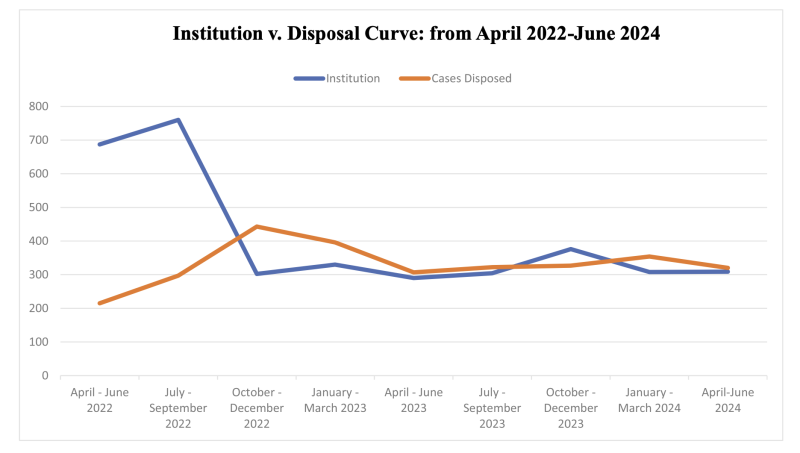

Efficiencies are also manifest in adjudication timelines, which have nearly halved. Final orders can now be obtained in one to three years, as opposed to three to five years previously. The graph below reveals how the gap is closing between the institution and disposal of IP suits at the Intellectual Property Division of the High Court of Delhi.

The success of the IP division has cemented the position of the High Court of Delhi as the leading venue for the resolution of IP rights disputes in India.

That said, on September 20 2024, the notification of the Intellectual Property Rights Rules of the High Court at Calcutta, 2023 was published in the Kolkata Gazette, making Calcutta the newest high court, after Delhi and Madras, to have its own dedicated IP division and relevant rules. Meanwhile, the Himachal Pradesh High Court has also notified The Himachal Pradesh High Court Intellectual Property Rights Division Rules, 2022 on July 8 2024, and the High Court of Karnataka formed a subcommittee on June 20 2024 to draft its IP division rules.

Final assessment: reports indicate a strengthening IP landscape in India

Overall, the statistics set out above offer a good yardstick to measure India’s maturing IP ecosystem, from the filing of applications to the enforcement of rights. Rising IP awareness in the country – backed by streamlined procedures and government initiatives to promote IP creation, such as the Startup India programmes – are fostering a robust IP culture in the country.