The market for electric vehicles (EVs) in India is experiencing significant growth in 2024 as the country accelerates towards a more sustainable future. This growth has mostly been driven by supportive government policies and changing infrastructure, which is buttressed by global advancements in technology, including in India.

Supportive government policies

EVs have come a long way in India since 2015, when the government introduced the Faster Adoption and Manufacturing of Electric Vehicles in India (FAME) scheme to tackle the release of greenhouse gases caused by the use of conventional fuels in vehicles.

Following FAME-1, which was operational from 2015 to 2019, the FAME-2 scheme was introduced, with the aim of enabling faster expansion of the EV market by cutting down on the initial investment costs. It was functional from April 2019 to March 2024, during which, subsidies amounting to INR52.94 billion were provided to manufacturers on the sale of 1,179,699 EVs.

According to various reports, a FAME-3 scheme is at a formative stage and will be released soon. FAME-3 is slated to offer financial incentives for the purchase of electric two-wheelers, three-wheelers, and government-owned buses.

The government of India also approved two production-linked incentive auto schemes in 2021, one with an outlay of INR259.38 billion to boost domestic manufacturing of advanced automotive technology products, including EVs and their components, and another with an outlay of INR181 billion for the manufacturing of advanced chemistry cells battery storage.

Such schemes have gone a long way in aiding the government in its aim of reducing, by 2030, greenhouse gas emissions intensity by 35% below 2005 levels, while also becoming a part of the global EV30@30 campaign, which is targeting the goal of ensuring that EVs account for at least 30% of new vehicle sales by 2030.

The schemes are also aiding in the setting up of charging facilities across the nation and providing incentives to citizens for the purchase of EVs. According to information received from the Ministry of Power, India has around 12,146 operational public EV charging stations, with the highest number of units being installed in the western state of Maharashtra.

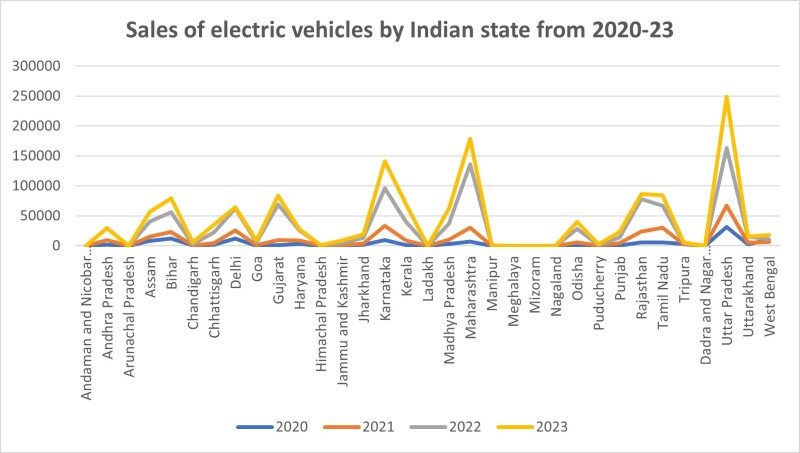

Combined with these schemes, a reduced goods and services tax for EV purchases and a waiver of road taxes have further bolstered the sale of EVs across the nation, as can be seen in the state-based sales chart below.

Source: Rajya Sabha Session 262 data, as published on https://heavyindustries.gov.in/

The government is also promoting the adoption of EV technology. According to The Economic Times, the government aims to deploy 60,000 e-buses through the National Electric Bus Programme and the PM eBus Sewa scheme. The Ministry of Heavy Industries has already sanctioned around 7,000 buses to various cities or state government entities for intracity operations.

The domestic market for EVs

There are around 35 electric cars and SUVs in the market already. The highest manufacturers of EV passenger cars in India have been Tata Motors, Mahindra & Mahindra, Maruti, and Kia, among others. In the EV two-wheeler segment, according to a report by the Society of Manufacturers of Electric Vehicles, Ola Electric, TVS Motor Company, Ather Energy, Bajaj, and Ampere are the biggest players. For three-wheelers (the legendary tuk-tuks), Mahindra Last Mile Mobility, Bajaj Auto, and Piaggio Vehicles are the main drivers of sales in FY 2023–24.

According to the Federation of Automobile Dealers Associations, the sale of EVs grew by 49.25% during 2023, as shown below:

Category | Calendar year 2022 | Calendar year 2023 | % growth |

Two wheelers | 631,464 | 859,376 | 36.09 |

Three wheelers | 352,710 | 582,793 | 65.23 |

Commercial vehicles | 2,649 | 5,673 | 114.16 |

Passenger vehicles | 38,240 | 82,105 | 114.71 |

Total | 1,025,063 | 1,529,947 | 49.25 |

India’s overall EV penetration is expected to increase at least eightfold by 2030, thereby increasing EV sales from their current 5% to about 40%. The market scale is anticipated to increase by $34.3693 billion. According to the e-Amrit (Accelerated e-Mobility Revolution for India’s Transportation) portal of the government, the Indian EV battery market is expected to surge from $16.77 billion in 2023 to a remarkable $27.70 billion by 2028.

Advancements in technology

The rapid evolution of EVs, leading to their increase in adoption, has also been a result of constant technological innovation fostered by patent protection. For instance, patents related to battery management systems and fast-charging technology have been pivotal in making EVs more practical and appealing to consumers.

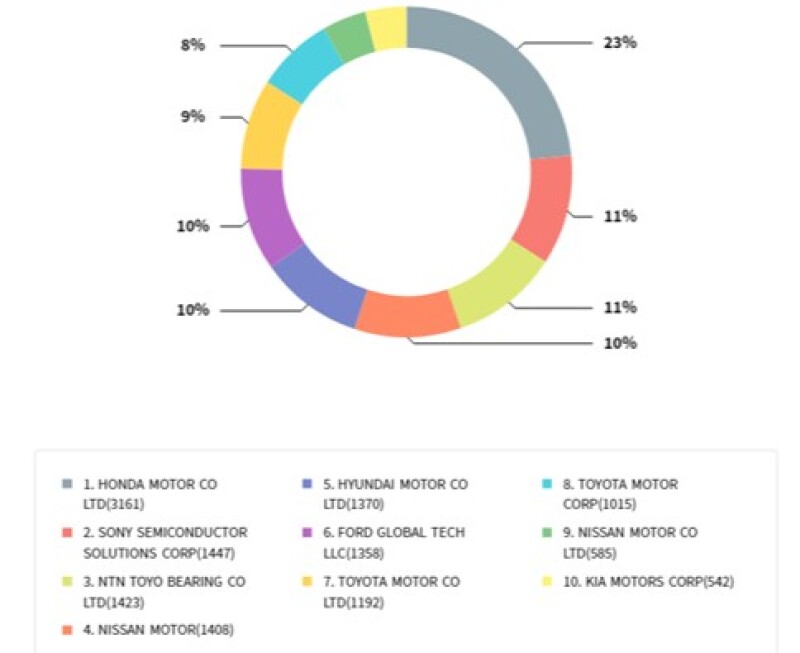

Honda Motor Co. seems to be dominating the patents concerning EV powertrains (the vehicle components that deliver power from the engine to the wheels) in the market, with about 400 patents related to batteries, which is 75% of patent applications. Companies such as Toyota, NTN, Nissan, Hyundai, and Kia have also joined the race.

Source: Derwent Innovation Reports

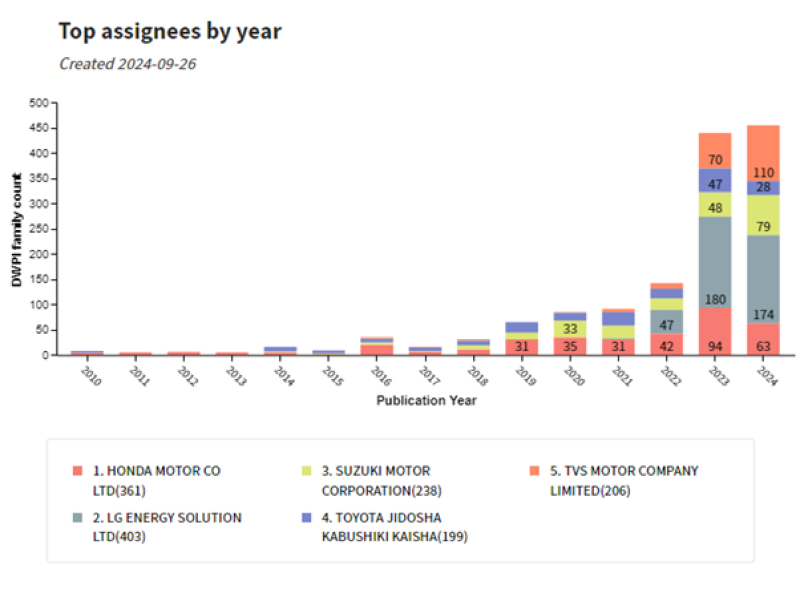

In 2023 and 2024, innovation has been centred around improving and strengthening technology related to batteries. Traditional lithium-ion batteries have become more efficient, along with the emergence of high-nickel cathodes and silicon-based anodes, which have enhanced density and are more robust. The focus has also been on solid-state batteries, which provide better charging efficiency, along with improved safety. Wireless or inductive charging systems are also being developed to provide more convenient charging solutions.

Players such as Honda Motor Co., Mitsubishi, Suzuki, Toyota, and TVS have contributed to innovation in such areas in the past few years.

Source: Derwent Innovation Reports

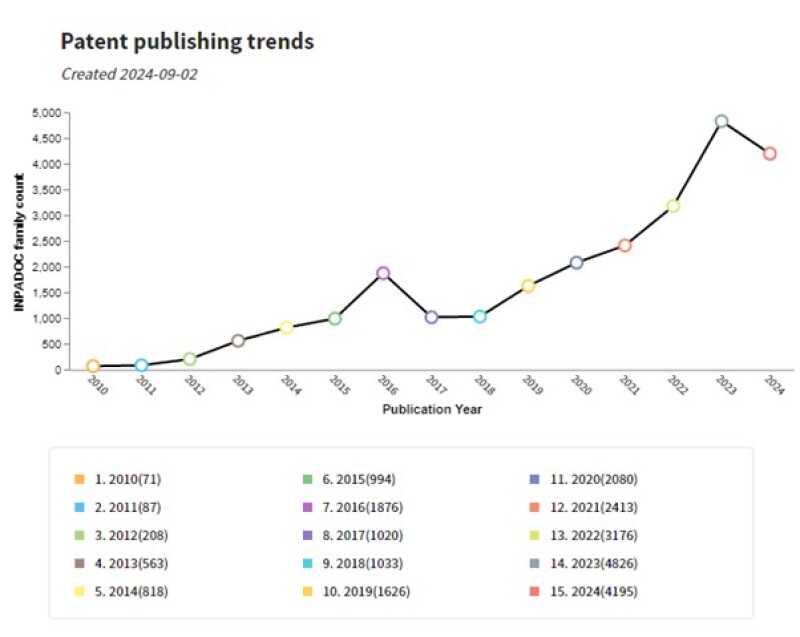

More than 25,000 applications for patents have been filed in EV-associated technology in India since 2010. The publication trends of the applications are illustrated below:

Source: Derwent Innovation Reports

Final thoughts on India’s EV market

India's EV market is experiencing significant growth, though it remains relatively modest compared with leading markets such as China, the US, and Europe. The success of these regions is attributed to their robust infrastructure, government policies, and larger markets, areas that India has the potential to improve so that it can make its mark in the EV segment in the near future.