Large generics drug companies are swearing off aggressive tactics over biosimilars to better ensure freedom to operate (FTO) in the market and mitigate the risk of haemorrhaging investment.

In-house sources at large generics drug companies say that they are finding it more difficult to secure FTO for biosimilars than small molecule products. This is leading them to be more diligent in patent searches, take legal action sooner and file for regulatory approval on more variations of a product.

“You cannot necessarily rely on the traditional generics cut-and-thrust approach to product launches because the dynamics in the biosimilars market are different,” says the assistant general counsel of a US-based generics company.

This FTO challenge has emerged because the biologics that biosimilars are copied from are often covered by more patents than the conventional small molecule products counsel are used to dealing with.

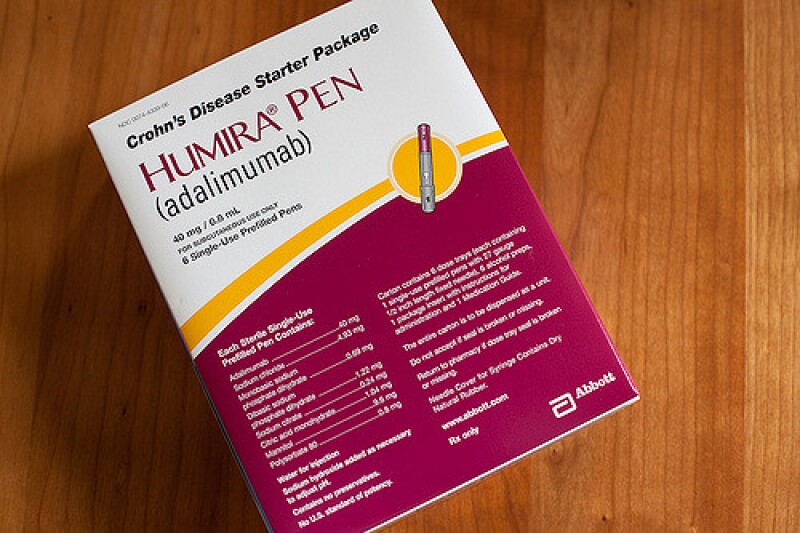

The blockbuster arthritis-treating drug Humira, which was copied and launched as a biosimilar in the EU last month, was surrounded by more than 70 patents. A US biosimilar of this drug is not expected until 2023 because of the patent thickets AbbVie has placed around it.

The head of IP at a European generics manufacturer explains that biologics are usually more complicated to produce, structurally complicated and difficult to formulate than small molecule drugs.

That complexity means biologic innovators can, and often do, have patents for the manufacturing methods, the way the product is expressed in a bioreactor or the way a protein is purified and formulated, along with the patents that relate to the drug itself.

Money problems

These patent thickets are a bigger problem for biosimilar launches than they might be for small molecule products because biosimilar development times are longer and require a much larger investment.

As such, if a company misses one of the many patents surrounding a biologic and cannot launch its biosimilar as a result, it could cost significant amounts in wasted resources.

|

|

“If you end up as the fourth, fifth or sixth player because your competitors did a better job at analysing the patent landscape than you, then you will have missed the market and wasted millions of dollars of investment” |

|

|

“If you invest in and manufacture a small molecule product and you have missed a patent, it costs money but it is not the end of the world,” explains the assistant general counsel. “But the investment for a biosimilar is so much bigger and you simply cannot afford to have stockpiles sitting in a warehouse going off.”

The European head of IP adds: “You cannot take risks, get it wrong and be on hook for a significant loss. I don’t know the exact numbers, but a drugs company may have 100 or more generics in development and only 10 biosimilars, and the latter still requires more investment.”

He points out that missing a patent could also lead to haemorrhaged investment by forcing a company to miss out on market penetration for its biosimilar product. The market dynamics in places such as the US, for example, are such that the first, second or third player in the market could grab a considerable market share.

“But if you end up as the fourth, fifth or sixth player because your competitors did a better job at analysing the patent landscape than you, then you will have missed the market and wasted millions of dollars of investment,” he says.

The head of IP at a US-based generics manufacturer adds that the financial implications of biosimilar litigation may also be enough of a reason to want to stay away from it. Biosimilars and their biologic counterparts, he explains, are more complex and it will cost a business much more to litigate or defend itself against an infringement action.

He says that the US biosimilar landscape is less developed than Europe’s – because the European Medicines Agency was a leader in developing a regulatory pathway for biosimilars – but even there, you can already see the litigation that comes from those products is huge, expensive and uncertain.

Getting certainty

Sources say that the market is still in its infancy and counsel have yet to fully develop their biosimilar launch strategies, but they are already taking steps to ensure greater certainty for their biosimilar launches to mitigate FTO risk.

The European head of IP says that the risk taken on in the development of biosimilars calls for a longer, more thoughtful and diligent due diligence process than generics companies have perhaps been used to.

The assistant counsel agrees, and adds that biosimilar companies are increasingly aiming to launch their products shortly after the original biologic supplementary protection certificate - expires and to clear secondary patent thickets at the IP offices until then.

|

|

“There will be earlier litigation and a lot more of it because of the patent thickets surrounding these products – but most will end in settlement because the stakes are so much higher on both sides” |

|

|

He points out that this is the strategy that Amgen followed when it launched its biosimilar for Humira in the EU.

The associate general counsel at a South America-based pharmaceutical firm says that despite the cost of litigation in the biosimilar market, the drive to strip patent thickets is increasingly leading companies to take start actions against patent holders at an earlier stage to clear the FTO path.

“There will be earlier litigation and a lot more of it because of the patent thickets surrounding these products – but most will end in settlement because the stakes are so much higher on both sides.”

He adds that this trend is indicated by cases such as Fujifilm v AbbVie, where the case was hard fought and aggressive and went all the way to the UK Court of Appeal before an Arrow declaration was filed and the matter was settled in 2017. An Arrow declaration states a patent application’s intended product or process was known or would have been obvious at the priority date.

“That was being fought two-and-a-half years ago for products that are just being launched now,” the associate general counsel says.

The US head of IP points out that the regulatory requirements for biosimilars may also be more complex and companies have to align patent litigation with regulatory approval.

Companies are also looking towards their regulatory strategies to ensure broader FTO. The European head of IP points out that there is a close inter-relationship between the IP landscape and companies’ regulator strategies, and companies will look to get approval for more variations of the same biosimilar product to better mitigate the risk of infringement.

“If you look at Sandoz’s strategy in the context of Humira – the firm obtained authorisations for three different brand names, each with a slightly different indication or use.

“Sandoz has clearly adopted this regulatory strategy to hedge its bets, and depending on how litigation plays out it could come to market with one of three different product labels to choose from to work its way around the patent.”