1 minute read |

Each year, our IP STARS researchers contact in-house practitioners to ask them which external IP and law firms that they use, and how they regard them. This year, we extended that research by asking a range of questions about in-house practitioners’ views and priorities, as well as their use of outside counsel. Questions asked covered the factors considered when choosing an outside provider; the preferred service model; review of external counsel; budget; the biggest challenge; and the Unitary Patent. We received over 1,100 responses and the results make fascinating reading. We have analysed them in detail based on both the region and industry of the respondent. A full report of the findings, with many charts, will be published online this month, and here we provide an introduction to some of the main themes. |

Managing IP's annual IP STARS survey is one of the longest running and most respected in the industry. During its 20-year history, the survey has evolved continuously, with landmarks being the decision to produce separate rankings for firms that specialise in prosecution work from those who look to contentious work (a move now widely copied elsewhere in the industry). The survey has now specialised even further with separate rankings in the US for firms that do biotech and ITC work.

To produce the rankings, Managing IP's team of researchers in London, New York and Hong Kong obtains information from thousands of firms and their clients by phone, online surveys, email and in face-to-face meetings. Researchers also conduct desk research for other available information. Among the attributes assessed are: the firm's workload, the quality of work and the strength of the IP team.

One constant of the survey is the importance placed on the feedback of in-house practitioners. Talking to those practitioners about the work they do with different law firms, why they chose them and how they would rate them against other firms they have given work to, always provides the research team with core knowledge that goes into the decisions on the rankings. In recent years, that relationship has been expanded with a more efficient online survey and the publishing of lists of in-house IP STARS to accompany the rankings of private practice lawyers.

Read the IP Stars Report |

To purchase this report or to find out if your firm is eligible for a FREE copy, please contact the relevant representative for your region: UNITED STATES: Michael Bijesse; Tel: +1 212 224 3480; Email: Michael.Bijesse@euromoneyny.com LATIN AMERICA & CANADA: Alissa Rozen; Tel: +1 212 224 3673; Email: arozen@euromoneyny.com EUROPE, MIDDLE EAST, INDIA & AFRICA: Nick Heath Tel: +44(0) 20 7779 8692; Email: nheath@managingip.com ASIA: Matthew Siu; Tel: +852 2842 6937; Email: matthew.siu@euromoneyasia.com |

In 2016 the research team took things a step further by designing a targeted set of questions (see box) to produce some verifiable and accurate data about these in-house practitioners. Essentially, we were looking to find out more about the work that they do, how they choose law firms and what their main concerns were. The response was impressive; over 1,100 practitioners from a wide range of industries and locations answered the questions. Those results have been tabulated and the data checked and analysed to look for different trends depending on the location of the companies, the role of the repondents, and the industries that they belong to.

Key findings

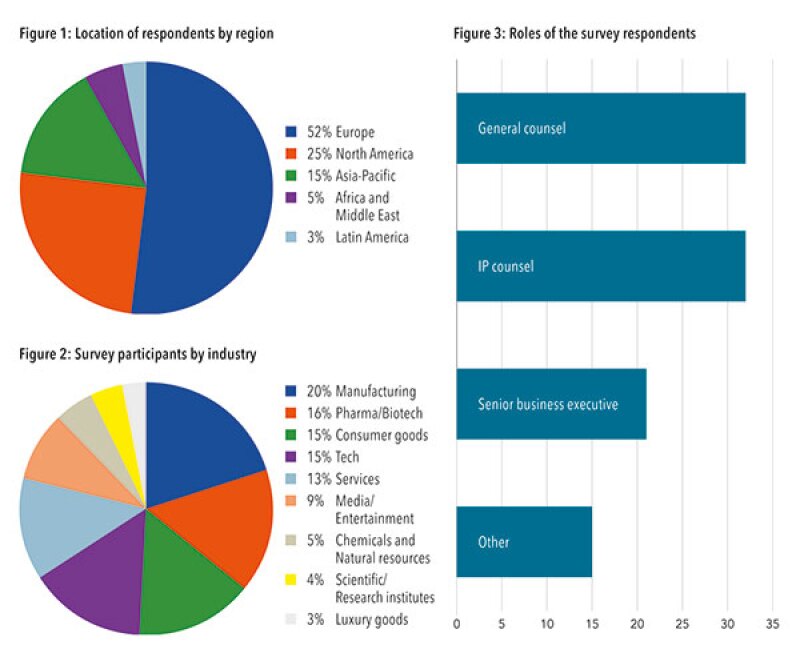

Over 1,130 in-house practitioners took part in the survey. We have broken down the participants by region, industry and job title. The majority of respondents were based in Europe, followed by North America, the Asia-Pacific region in third and Africa and Middle East combined coming just ahead of Latin America. We defined location by the country that the respondent was based in. This means, for example, that an in-house lawyer working for a US-based company in Shanghai would be classed as being in the Asia-Pacific region. Classifying respondents in this way was important for question 5 – the biggest challenge facing IP owners in their jurisdiction.

The IP STARS team also placed the respondents into different industry groups. There are many different ways to do this and we tried to bear in mind how IP issues affect different industries. For example, the pharmaceutical and biotechnology industries are clearly IP intensive and share the same concerns (though originator and generic companies sit on different sides of some debates), tech is now a well defined group with a distinct set of IP challenges, while the media and entertainment industry face a lot of similar challenges on piracy and IP enforcement in general. Although they only make up a small proportion of the respondents, the luxury goods industry was kept separate because of the paramount role that protection of trade marks plays in the sector.

The in-house survey |

The IP STARS questionnaire for law firms includes a section where they can nominate clients that they have worked with. Those contacts formed the basis of this list. In addition to gaining extensive feedback about those firms and asking for basic details, the IP STARS research team also asked all the clients the following questions:How important are the following factors during your search for an IP service provider? (Options were very important, moderately important or not important)

Which service model do you prefer for IP work? (One stop shop for IP prosecution, litigation and transactional work or other)

Are you intending to review your external IP counsel or agent over the next 12 months? (Yes, no, unsure)

Do you expect your budget for legal or prosecution services for IP to change over the next 12 months? (Increase, decrease, remain the same)

What do you consider to be the biggest challenge facing IP owners in the jurisdiction you are based in?

Does your company intend to use the incoming Unitary Patent system in Europe? |

It is also worthwhile looking a little deeper at the regional breakdown of the different industry groups. Figure 1 shows that, overall, around half the respondents were based in Europe, one quarter in the US and 15% from Asia-Pacific. The distribution of manufacturing companies, consumer goods and pharma/biotech was roughly similar to this overall split. But North America was the biggest provider of tech companies (43% of that total) with Europe on 33%. In contast, Europe provided 69% of the luxury goods companies, with Asia-Pacific in second place. The Asia-Pacific region provided 28% of the scientific/research institutes in the survey and 24% of the companies in chemicals and natural resources, significantly above its overall average of 15%. The majority of respondents from Africa and the Middle East were involved in services (23% of the number of companies from that region) with tech in second place. From Latin America, consumer goods was out in front with 32% of the total number of companies from the region, with services in second place on 18%.

We left the section where respondents could specify their role as an open field, and then grouped the answers into four categories: IP counsel (which included any specialist IP role that focused on registration and enforcement) general counsel (any kind of title that involved a legal role beyond IP) senior business executive (the c-suite, vice presidents, managing directors) and other. The results are shown in Figure 3. In an interesting coincidence, we had exactly the same percentage of general counsel and IP counsel taking part in the survey – 32%. Senior business executives made up 21% of the total.

This apparent uniformity, however, hides a wide difference between the regions. Europe had the same number of general counsel and IP counsel but they were a lower percentage of the total – 30% – with senior business executives slightly higher at 23%. In North America, 45% of the respondents were IP counsel, 36% general counsel and only 15% senior business executives. So, it seems that Europe is evenly split on the need for a specialist IP counsel, and happier to put the top level of the business in charge of dealing with outside counsel. In the US businesses like to have in-house practitioners, whether IP specialists or general counsel, in charge of that relationship. This provides an important message for law firms looking to win their business. In the US, the in-house counsel is the person to target, while in Europe, it might make sense to look at senior business executives as well.

While it is to be expected that North America, which contains the world's most sophisticated IP market, has the highest proportion of IP counsel, other regions are not as far behind as might be expected. In Africa and the Middle East, 32% of respondents were general counsel, 23% IP counsel and 27% senior business executives, relatively similar to the overall results. In Asia-Pacific the ratio is comparable – 28% general counsel, 22% IP counsel and 25% senior business executives. Latin America had exactly the same percentage of IP counsel – 22% – with 53% general counsel and only 17% senior business executives.

The full IP STARS In-House Practitioners Report will be available to download in May from managingip.com/IPSTARSReport. The download is priced at $1,250, but is free for sponsors of IP STARS. More information is available online, or at our INTA Exhibit Hall booth #207